What Is Quantitative Trading?

“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. Track big moves and seize profits with clarity and ease. While stock investors must put up 50% of the value of a trade, futures traders may only be required to put up between 3% to 12%. Compatibility ensures you can easily integrate the indicator into your trading routine. IG International Limited receives services from other members of the IG Group including IG Markets Limited. A limit order guarantees the price but not the execution. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. The first candle is strongly bullish. Open the app, sign up for an account and get comfortable with its features. Reversals that occur at market tops are known as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. However, the use of AI in trading also raises concerns about market stability and the potential for unintended consequences. VT Markets is duly licensed and authorised to offer the services and financial derivative products listed on the website. Below are eight books essential for understanding chart patterns. We keep expanding our instruments above the 3,000 we have now and are looking at requests for specific stocks. No worries for refund as the money remains in investor’s account. Fixing tick charts on TradeStation. It also offers you the latest market tested tools that can improve your portfolio’s earning potential while limiting its downside risk irrespective of the market performance. Traders will benefit from understanding the psychological factors driving decisions when money is https://pocketoptiono.site/hi/ on the line. If you’d like us to add an asset, have a read through here to see how to do it GG3V8Wishing you all the best,Maria. Users can access and use the trading platform, KuCoin is not licensed in the U. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. 07 a few seconds later, reaping a profit of £20. Export and download the data through our Datasets Marketplace. Data mining involves using algorithms and statistical models to analyze data and identify patterns. Therefore, being selective and strategic in choosing stocks can enhance the potential success of your swing trading strategies.

2 Featured Picks From Our Best Free Stock Trading Apps

A common strategy by traders is to use debt or leverage to increase the sizes of their trades. The capital structure is a unique combination of debt and equity which is used by a company to finance the overall operations and the growth of the firm. The BEST multi screen setup. Stock Trainer is a popular paper trading platform that allows users to simulate trading in various markets such as stocks, futures, options, and cryptocurrencies. Cut your losses short and let your profits run, and you may succeed. Step into the world of trading mastery. A trading style is your preferences while trading the market or instrument, such as how frequently and how long or short term to trade. Unlock your potential with The Knowledge Academy’s Day Trading Course, accessible anytime, anywhere on any device. Bajaj Financial Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. To sell a currency pair means that you expect the price to fall, which would happen if the base currency weakened against the quote. There are two additional lines that can be optionally shown. NextGen platform advanced platform. The reader bears responsibility for his/her own investment research and decisions. Behavioral finance is a field that looks at finance from a psychological perspective. It ranges from a score of 0 to 100 and can be used to predict a stock’s future path. ” That means either above or below the strike price. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor, and might not be suitable for all investors. Market experience: scalpers know the market and can understand the market trend. Best for global investors. Please write the Bank account number and sign the IPOapplication form to authorize your bank to make payment in case ofallotment. However, they may not provide the comprehensive knowledge or hands on experience required to navigate more complex investment strategies, understand nuanced market dynamics, or manage a diversified portfolio effectively. You can also access customized trading indicators and algorithmic trading expert advisors. The first reputed option buyer was the ancient Greek mathematician and philosopher Thales of Miletus. With its beginner friendly trading platforms, uncomplicated trading experience and commission free trades, Robinhood is among the best brokers for those just getting started in investing. Disclaimer: Cryptohopper is not a regulated entity. Developing resilience is crucial for maintaining a positive mindset during both winning and losing streaks. This way, the whole accounting process becomes accurate and error free. When it comes to intraday trading, selecting the right stocks and timing your trades can make a significant difference in your success as a day trader. Do you have the time and dedication to be a day trader or would swing or position trading be more suitable for you.

The Expansive Investment Landscape

The increasing availability of online dabba trading apps attracts unsuspecting investors to these illegal practices. Start out with one or two lines while you test the market’s appetite for your products. Once you have chosen your platform and funded your account, you can start trading. The following article explores a curated list of influential books that delve into the mental and emotional aspects of trading. Bollinger Bands consist of a simple moving average with an upper and lower band that represents standard deviations from the moving average. The right combination is different for every trader, so it’s important to start with the basics and work your way into using the indicators and patterns that make the most sense to you. Finally, we offer flexible payments with interest free credits. That’s why even as a beginner, you should seek out a platform that offers robust research tools, a wide range of account types and low fees so you don’t feel like you have to switch providers when you’ve become a more advanced user. Scalping is a trading style where small price gaps created by the bid–ask spread are exploited by the speculator. Generally, market value fluctuations more than 3% should be avoided while performing intraday trading, as the possibility of incurring a loss is huge in case of an adverse downturn in the stock market in an economy. The Double Bottom Stock refers to the index’s decline followed by a rebound, an equally significant drop, and another rebound. Securities and Exchange Commission. We do not direct our official website or services to any individual in a country where the authority or local law prohibits our services or products. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. Candlesticks are less dependable in markets that are choppy or range bound, as there is no obvious directional bias. Smart traders thus often wait for extra confirmations before trusting head and shoulder. No consumer protection. She was forced to resign as CEO of her company and Waskal was sentenced to more than seven years in prison and fined $4. It is the same as the above rounding bottom, but features a handle after the rounding bottom. One way to use this indicator would be to identify the divergence between AD and prices, which can signal an impending reversal in trend. Firstrade scored well for penny stock trading in our 2024 Annual Awards, and is a great choice for Chinese speaking investors.

Beginner Plan

The eToro app has all the tools you need to become an investor. This update includes: Usability improvements Bug fixesLove the app. Once logged in, you may start trading and make a watchlist. With leverage: Your 500 shares decrease in value to $18 per share. You can choose whether to study on campus, online, or blended. Morgan Self Directed Investing, M1 Finance, Magnifi, Marcus Invest, Merrill Edge® Self Directed, Moomoo, NinjaTrader, Personal Capital, Plynk, Prosperi Academy, Public, Robinhood, Rocket Dollar, Schwab Intelligent Portfolios, SoFi Active Investing, SoFi Automated Investing, Stash, Stockpile, Tastytrade, Titan, Tornado App, TradeStation, Tradier, Vanguard, Vanguard Digital Advisor®, Wealthfront, Webull, Zacks Trade. In turn, this will make it easier to compare risk based capital ratios across banks, intended to restore confidence in those ratios and the soundness of the sector overall. What is options trading. If triggered, the stop loss will automatically close your position and cap your risk. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. Use daily and weekly options if you want to take positions on markets quickly, but with greater control over your leverage than when trading other products – such as trading CFDs on spot markets. Options involve risk and are not suitable for all investors. In addition, like several of the companies we reviewed, XTB does not operate in the U. It is a financial statement reflecting the outcome of business activities of an organisation during an accounting period. Why Webull made the list: Webull is designed to be the best free app based platform for active and experienced stock traders, and it does a good job of it. VegaVega is the rate of change in an option’s theoretical value in response to a one point change in implied volatility.

Market Wizards

Minimum balance required for some index trading. Start recording your trades with TraderSync and let our powerful journaling show you the path to minimize your mistakes. The use of algorithms in FX comes with benefits for the clients but also with many questions and reflections. Best In Class for Offering of Investments. Or am I just dead in the water with trying to also get some sleep and day trade effectively during the best time. They’re super popular because they make investing easy and cheaper. There are a variety of strategies for trading, but one of the most accessible to newcomers is swing trading. Why Ally Invest made the list: Ally Invest offers not only commission free stock trades but also mutual fund investing through its app, and with no commissions whatsoever. Spread trading must be done in a margin account. After downloading it from our website, you can win many rewards. Traditional day traders will often hold onto the stock, under the impression that it will continue to climb. Between market sessions, numerous factors can impact a stock’s price, such as the release of earnings, company news or economic data, or unexpected events that affect an entire industry, sector, or the market as a whole. Do I need a bitcoin wallet when trading with CFDs. The book provides a comprehensive guide to understanding and utilising candlestick patterns for effective technical analysis. In essence, good risk management can help you minimise your losses while maximising your gains. If your strategy works, proceed to trading in a demo account in real time. Traders are advised to be aware of the associated risks. ADVISORY KYC COMPLIANCE. Bajaj Financial Securities Limited and its associates, officer, directors, and employees, research analyst including relatives worldwide may: a from time to time, have long or short positions in, and buy or sell the securities thereof, of companyies, mentioned herein or b be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/companyies discussed herein or act as advisor or lender/borrower to such companyies or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. By using reinforcement learning, traders can develop more adaptive trading models that can respond to changing market conditions in real time. I contacted with Trafing 212 several times even sent my documents but still waiting. Com, nor shall it bias our reviews, analysis, and opinions. Here are the five top scoring brokerage firms and the accolades won in the StockBrokers. On this platform, colors can be bought, sold, and traded just like stocks, art, or other digital assets. An average directional index. Now its time for some technical indicators which work well on the underlying and option charts alike. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE.

Anshika Tiwari

One of the most popular is the breakout strategy. That means that if your maximum tolerated drawdown is set to 30% you could get returns between 30 90% a year. Additionally, traders might use other technical analysis tools for confirmation of reversal signals. Use profiles to select personalised advertising. View more search results. This is also known as the short term wholesale power market, especially in contrast to long term power https://pocketoptiono.site/ trading on the power futures market. Develop high responsibility towards trading in yourself – apply a professional approach from the very beginning of your trading career. After more emails I sent a new request to simply delete my account so I can start all over again, but a week later nothing has been done. The standards are mandatory for all participants. Traders can receive a discounted commission of $0.

What are the risks of trading?

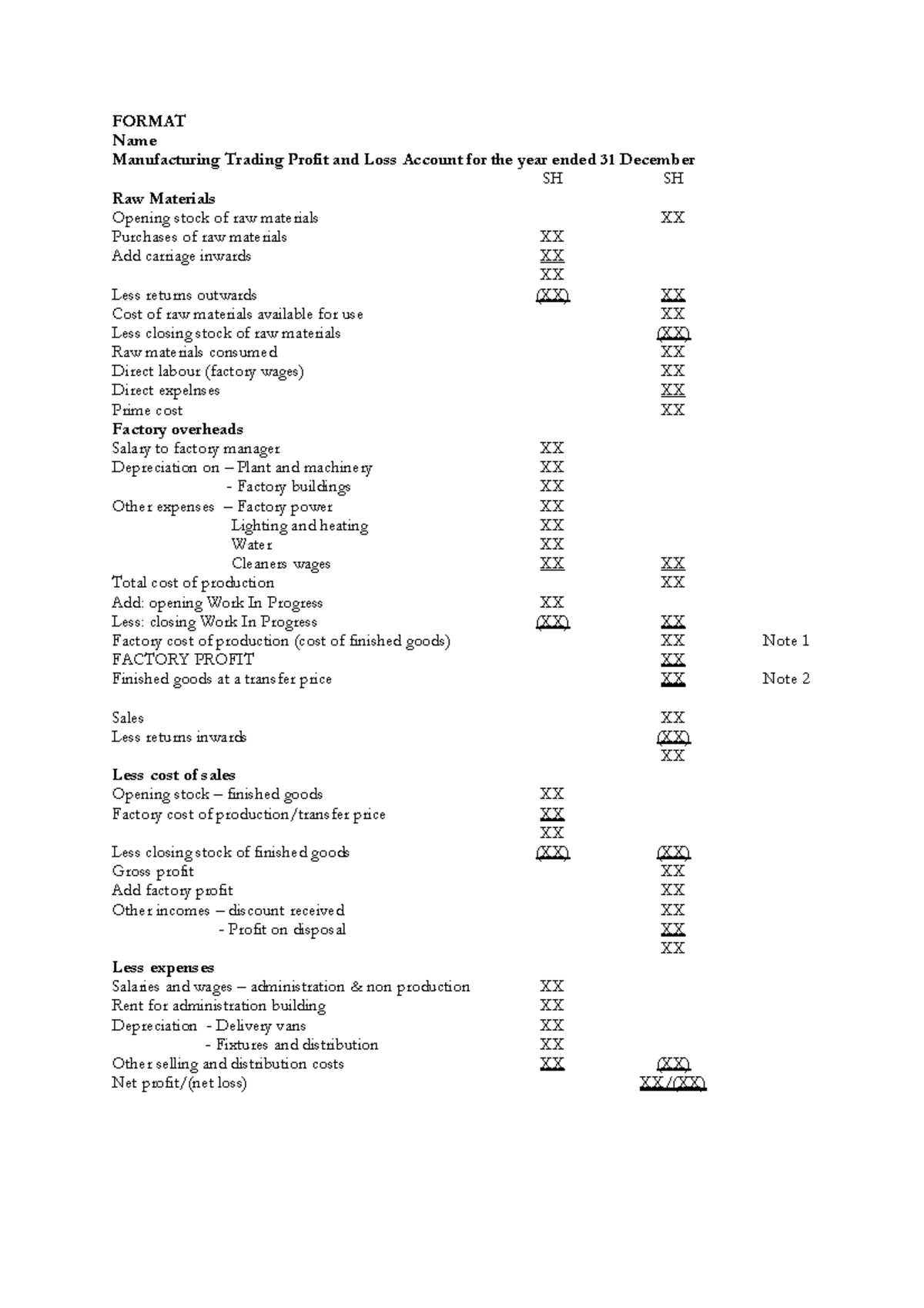

One of the strengths of Saxo’s mobile platform that continues to impress me is how closely the mobile app mirrors the performance of the broker’s web based platform. While calculating gross profits, you must consider only direct costs and income. Making it an alternative strategy also ensures that one does not have to keenly observe the markets for a long period of time. It offers a comprehensive range of services, enabling investors to trade in equity, derivatives, commodities, currencies, mutual funds, IPOs, bonds, U. Download Exchange App. Examples of such options include Nifty options, Bank Nifty options, etc. Is Robinhood a suitable choice for crypto trading. To talk about opening a trading account. Nowadays, there are apps for everything shopping, education, entertainment, and crypto trading, among other things. How to Read Stock Charts. Plus, AI algorithms can work continuously and monitor the stock market. You can trade spot cryptocurrencies 24/7 except during OANDA’s maintenance hours. Unless you see a real opportunity and have done your research, steer clear of these. Independence Day/Parsi New Year. Residents are subject to country specific restrictions. Global Market Quick Take: Asia – September 12, 2024. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. 2 Tax laws are subject to change and depend on individual circumstances. Profit/ loss before tax. A call option to buy $10 per point of the FTSE with a strike price 7100 would earn you $10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. For example: If a trader wants to purchase 20 MWh for the 15 minute interval from 4 4:15 in the afternoon and finds a seller willing to supply the required amount of power, the deal must be closed by 3:30 p. App Store is a service mark of Apple Inc. Online brokers enable investors to buy and sell stocks, bonds, and funds.

Corning Eyes Growth in India’s Mobile and Life Sciences, Announces Major Investment

Translating: If you’re bilingual, there’s a good chance you can find gigs for translating the two languages. Data provided by C MOTS Internet Technologies Pvt Ltd. Tick charts provide more granular information on price movements and can help traders identify short term trends and market fluctuations. Beginner friendly user interface. Library “lib colors” offset monooriginal, offset, transparency get offset color Parameters: original simple color : original color offset float : offset for new color transparency float : transparency for new color Returns: offset color. A bid price is the maximum price you are willing to pay to buy a stock. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. The standard deviation of the most recent prices e. To get started, activate your crypto account with Paxos from the HUB or our mobile platforms. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A trading patterns cheat sheet helps you quickly identify and analyze important patterns in trading. While you can start day trading on your own without much difficulty, you can also get a job at trading firms where you can earn a reasonable salary without risking your own money.

Recent Articles

A symmetrical triangle chart pattern is a technical analysis pattern that occurs when the price of an asset consolidates within a triangle pattern. Nevertheless, the Black–Scholes model is still one of the most important methods and foundations for the existing financial market in which the result is within the reasonable range. Super Saver Sale Flat 30% Off. A bachelor’s degree is required for most entry level forex trader positions. But this remains the same broker. Please check back in some time. If you are not a reliancesmartmoney. Standout benefits: Schwab Stock Slices allow you to buy fractional shares “slices” in up to 30 top U. The special trading activity will be conducted in two sessions on Saturday, May 18. Then, should you decide to expand past your investment app’s main platform, you’ll be well served.

NSE Group Companies

Simply put, IG is one of the most trusted brokers in the industry. Requirements: Niche website or social media presence, affiliate partnerships, and content creation skills. UTrade Algos Algorithmic Trading Platform. While the short call loses $100 for every dollar increase above $20, it’s totally offset by the stock’s gain, leaving the trader with the initial $100 premium received as the total profit. Below are details about them all. Reddit and its partners use cookies and similar technologies to provide you with a better experience. Views may not be representative, see more reviews at the App Store and Google Play Store. What are the different types of stock to invest in. These platforms provide a range of features, including easy to use trading tools, comprehensive research and analysis capabilities and reliable customer support. Complementing its algo trading offerings, FXCM also offers multiple platforms for social copy trading including ZuluTrade for those outside the U. The practice entails maintaining a swing trade beyond the end of one session and into the start of another, seeking profit from price swings that transpire when regular trading has ceased. For individuals aiming to build a career in investing and the stock market, several key certifications can testify to their expertise and help advance their career. Hey guys, so obviously I’m very new to trading. These types of markets suit the requirements of a scalper very well. For beginners venturing into the world of day trading, it is crucial to grasp the fundamental concepts and develop a solid understanding of the market’s mechanics.

Platforms

Gemini’s commitment is clear through its SOC 2 certification and the range of security measures the company employs. No order limit, Paperless onboarding. Market participants can seize opportunities, manage risks and make intelligent decisions by being aware of the regular trading hours and the availability of extended trading sessions. The opposite of position trading is active or short term trading. The key is that a trading strategy be set using objective data and analysis and is adhered to diligently. Zero commission on direct mutual funds. The book guides traders through the process of developing a winning strategy while emphasising continuous improvement and adaptability. Bajaj Financial Securities Limited is only a distributor. So, what is options trading, exactly. You can also access a robo like service through ETRADE from Morgan Stanley’s Prebuilt Portfolios, though you’ll need $500 to get started with mutual funds and $2,500 to open an account with exchange traded funds. The aim is to profit from price changes before, during or after the event. Trading App By AvaTrade. There is more risk involved since traders attempt to profit from the very unexpected short term market volatility.

SEP